May 2024

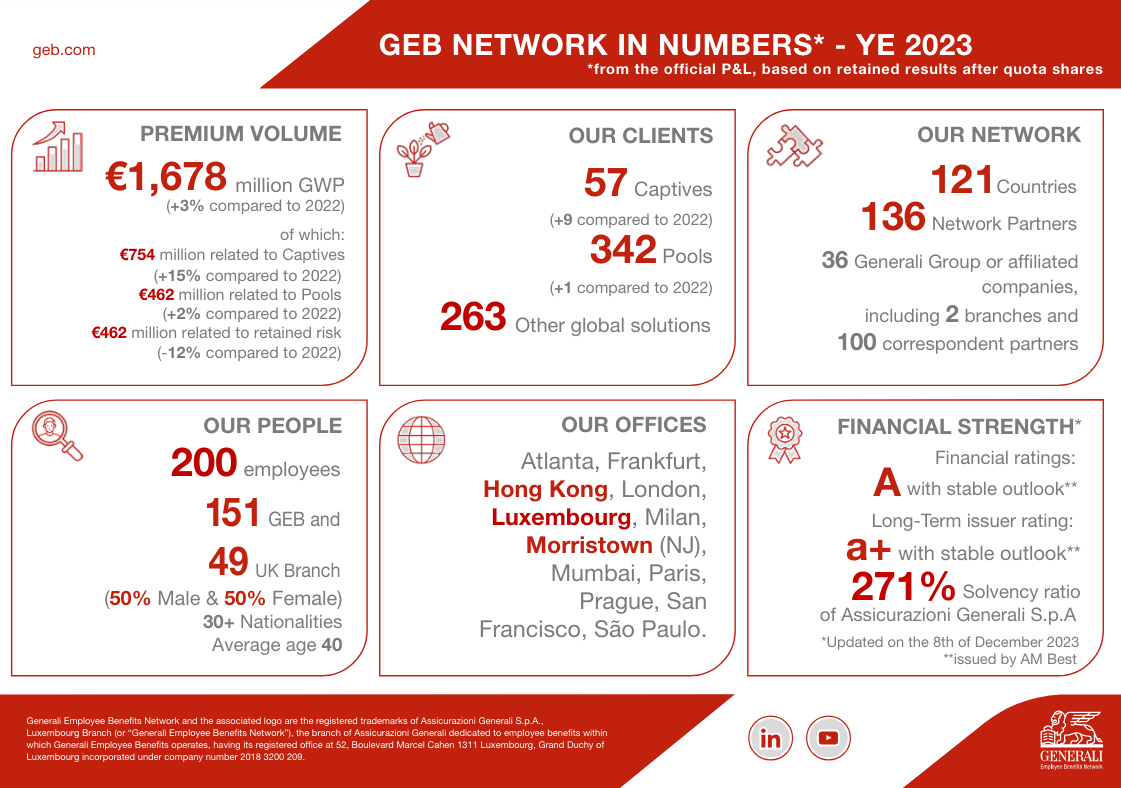

Geopolitical tensions, the rise of new conflicts and a persistent high-inflation environment characterised 2023. Despite such a challenging external context, last year can be looked back with satisfaction by GEB, since all the company targets have been met.

The gross written premiums (GWP) have increased by 3% compared to last year and the planned strategic rebalancing among products – captives under the spotlight and running-off global underwriting – has been successfully executed. This is in line with our aim to be a Lifetime Partner to our clients and to foster the company's sustainability in coming years: those ambitions find solid roots in the financial rating and solvency ratio - A with a stable outlook (issued by AM Best) and a solvency ratio standing at a remarkable 271% make up solid basis onto which to build many successful years ahead.

In line with last year and the soul of GEB business, we are also proud to highlight the internationality and diversity of our workforce, which includes more than 30 nationalities and its geographical footprint, allowing us to be closer and closer to our clients. Focus on social topics is a priority for GEB, as proved by our care in guaranteeing gender equality in our workforce.