May 2022

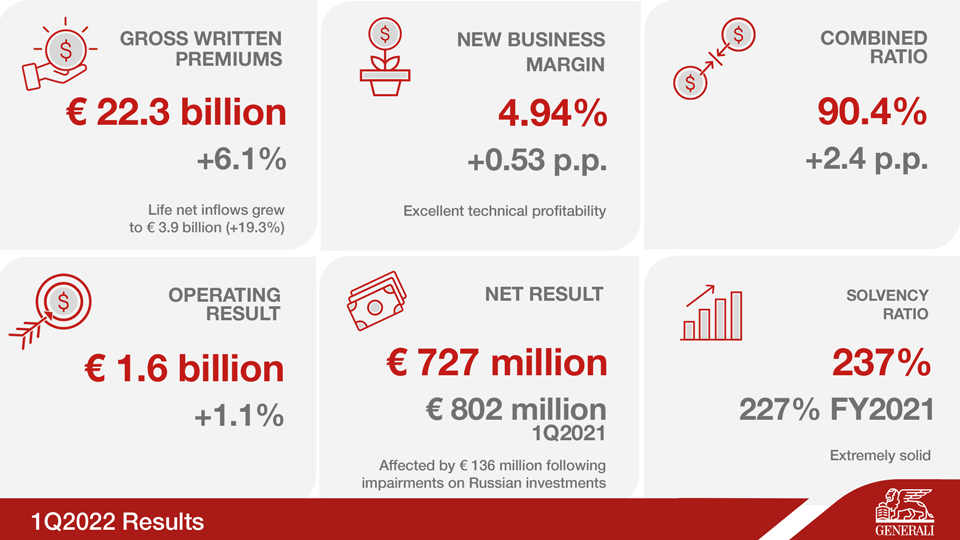

Excellent profitability with growth in premiums and operating results. Extremely solid capital position.

Net result affected by impairments on Russian investments

- Gross written premiums increased to € 22.3 billion (+6.1%), up in the P&C (+6.4%) and Life (+6%) segments. Life net inflows entirely focused on the unit-linked and protection lines, grew to € 3.9 billion (+19.3%)

- Operating result rose to € 1.6 billion (+1.1%), thanks to the positive performance of the Life, P&C and Holding and other business segments. The Combined Ratio was at 90.4% (+2.4 p.p.) and the New Business Margin was excellent at 4.94% (+0.53 p.p.)

- Net result reached € 727 million (€ 802 million 1Q2021), affected by impairments on Russian investments amounting to € 136 million. Excluding this impact, the net result would have been € 863 million

- Solvency Ratio remained extremely solid at 237% (227% FY2021)