Boosting your governance, together

Enhanced global governance

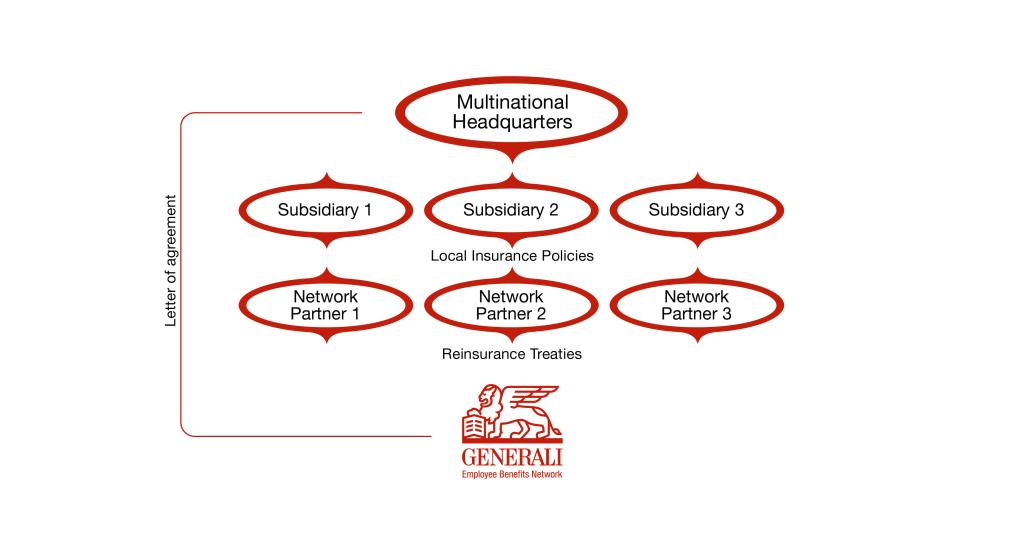

Marked by its passion for innovative solutions, GEB was the first Network to develop a brand-new funding method for international employee benefits plans. GEB’s Global Underwriting solution enables clients to manage local and cross-border employee benefits centrally, increasing transparency and enabling further cost control.

Global Underwriting solution at a glance

Providing our multinational clients with an international risk management for employee benefits cover worldwide. This solution is based on a proactive funding strategy and encompasses enhanced terms and conditions negotiated centrally, risk guaranteed rates and upfront pricing optimisation across the entire programme.

The Global Underwriting approach is built on:

- Commitment to a long-term partnership (a minimum of three years)

- Strong control on the client’s side

- Technical expertise and pricing flexibility from the insurer

The key elements of a successful rollout of a Global Underwriting strategy are:

- Extended rate guarantees

- Improved terms and conditions

- Enhanced governance both locally and centrally

- Proactive global solution management at the initial quotation and renewal stages

- Premium optimisation through technically sustainable upfront discounts based on combined ratio analysis

The GEB Global Underwriting solution is designed to accommodate the full range of insured group policies, except for pensions, that are typically offered to employees, including the following Lines of Risk:

- Life

- Disability

- Accident

- Medical and dental

- EUR 3,000,000 in annual Global Underwriting premiums*

- Minimum of five countries to cover

- If a Global Underwriting solution has already commenced, additional Lines of Risk can be included mid-cycle. However, these Lines of Risk will not be governed by the Global Underwriting framework until the next renewal of the agreement.

* For premiums to be taken into consideration, they must be placed with GEB Network Partners.

The Global Underwriting solution is available in the EUR, USD, CHF and GBP currencies. There are no implementation costs to set up a GEB Global Underwriting solution.